A small mistake in documentation can lead to shipment delays, penalties, or even cancellation of your export-import deal.

That’s where our professional export import documentation services come in — to ensure smooth, Hassle-free & compliant free trade operations.

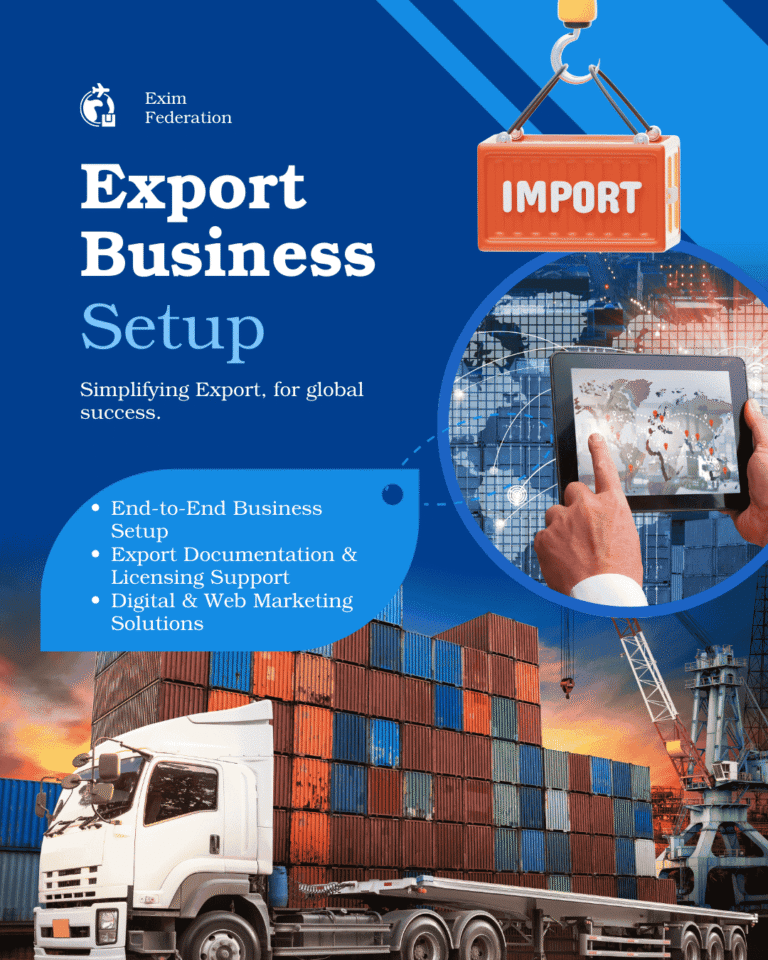

Exim Federation consultation & support for setting up your International business with all required legal formalities required as per types of structure your willing to go for from following:

Proprietorship

Partnership Firm

LLP (Limited Liability Partnership)

Private Limited Company

One Person Company (OPC)

Federation provides Hand holding support & guidance in preparing Hassle free export documentation required Pre & Post shipment which includes :-

✅ Pre-Shipment Documents:

Proforma Invoice

Packing List

Commercial Invoice

Inspection Certificate (if required)

Shipping Instructions

✅ Post-Shipment Documents:

Bill of Lading / Airway Bill

Bank Realization Certificate (BRC)

Insurance.

Foreign Exchange Declaration Forms

Federation provides Hand holding support & guidance in preparing Hassle free export documentation required Pre & Post shipment which includes :-

✅ Pre-Shipment Documents:

Proforma Invoice

Packing List

Commercial Invoice

Inspection Certificate (if required)

Shipping Instructions

✅ Post-Shipment Documents:

Bill of Lading / Airway Bill

Bank Realization Certificate (BRC)

Insurance.

Foreign Exchange Declaration Forms

We provide registration of EPC for obtaining their RCMC Certificate to access government incentives, schemes, and global trade opportunities. With our guidance, you can register with the right council for your product category and start enjoying export benefits.

Exim Federation helps exporters stay fully compliant with GST & RoDTEP to ensure smooth operations & timely benefits :

1. GST for Exporters:

– GST registration & advisory with LUT filing for zero-rated exports2. RoDTEP Scheme Support:

– Guidance on RoDTEP eligibility & benefits

– Mapping products with correct HS codes & rebate rates

– Application & claim filing via ICEGATE3. Compliance & Documentation:

– Export invoice format as per Int. rules

– Guidance for Maintaining records for audits & refund claims

– GST refund for exporters (if taxes paid)

Confused by export paperwork? Our experts make it easy and export-ready in no time.

Book a Call“Exporting Made Easy — Backed by Data, Compliance & Real Buyers.

Clients Export Success stories.

It is one of the primary sales document containing buyer seller details, product, value details & it is required mainly for customs clearance and bank processing, Logistics & finance related information.

Packing List mainly helps Receiver, customs officers & warehouse management mainly to verify quantity, weight and package details to ensure smooth inspection & cargo handling.

COO mainly helps to certifies the origin & manufacturing country of goods and it required for duty benefits or compliance in importing countries.

Bill of Lading (B.L.) acts as a proof of shipment, contract of carriage by shipping line or airline and document of title may require for payments.

Proforma Invoice provides formal quotation to importer which helps to buyers arrange LCs, advance payments, and import permits.

Phytosanitary Certificate certifies & declare the Agri products & plants meet international health standards, preventing quarantine issues.